Coronavirus hits De Beers sales

(Image courtesy of De Beers Group)

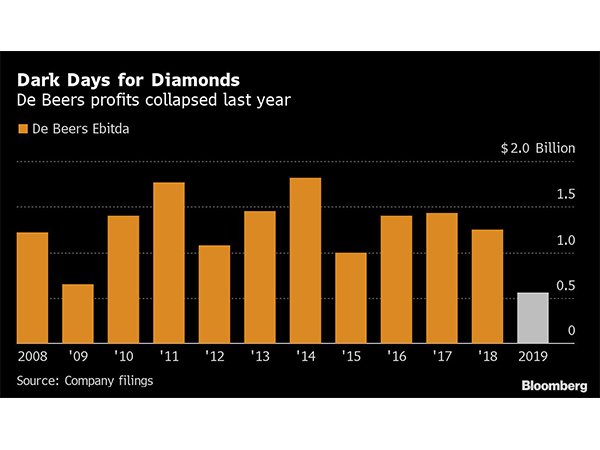

Just when the diamond market was beginning to show signs of recovery, De Beers, the world’s largest producer by value, revealed that the outbreak of the Covid-19 coronavirus had affected its sale of roughs in February, which dropped by 36% from January.

The company sold $355 million of rough diamonds in the second cycle of the year compared with $551 million for the first cycle of the year, as it deferred allocations due to the virus impact on Chinese focused customers. The figure was 28% lower than sales in the same period of 2019.

China accounts for about 14% of global consumption of polished gems, making it the biggest market outside the US, data from De Beers shows.

De Beers, which sells diamonds to a handpicked group of about 80 buyers 10 times a year at events called sights, has reported sales of $906 million so far this year, the slowest start since it first released data on its sales in early 2016.

In February, it reported its worst set of earnings since Anglo American (LON:AAL) acquired it in 2012.

“Today’s sales miss should not come as a surprise to the market given the disruption caused by the Covid-19 outbreak,” Morgan Stanley analysts said in a note.

The investment bank cut its full-year diamond sales forecast of $4,3 billion by 2% after De Beer’s sales data.

Global demand for all types of diamonds fell between 2018 and 2019, affecting small stones producers the most, due to an oversupply in that segment that dragged prices down.

Increasing demand for synthetic diamonds also weighed on prices. Man-made stones require less investment than mined ones and can offer more attractive margins.