Firestone to delist, trim board on tough diamond market

Africa-focused Firestone Diamonds (LON:FDI) has decided to leave the London Stock Exchange and reduce the size of its board in an attempt to reduce costs and ride out a lingering weakness in the global diamond market.

Shares in the company, currently traded on the AIM exchange — the LME’s submarket for juniors — have collapsed in recent years. From 56.8p a piece in October 2016, the stock has fallen to just 0.30p as of Tuesday at 12:15 pm local time, leaving it with a market cap of £2.7 million ($4.7 million).

Firestone’s investors are expected to vote on the delisting on March 13. The miner, which has been on the AIM since 1998, needs over 75% of voting shareholders to approve the motion for it to go ahead.

The company, which began mining at Liqhobong, Lesotho, almost four years ago, said it became clear in 2017 that it wouldn’t achieve the anticipated average value per carat.

As a result, the 75%-owned subsidiary operating the mine ran into problems paying back debt to South Africa’s Absa Bank Ltd. A fundraise and debt restructuring occurred in 2017, including a standstill agreement lasting until mid-2019, during which Firestone’s subsidiary only paid back interest on debt.

“The board still believes the diamond market has the potential to improve, but that it will take longer than had been previously anticipated, and therefore everything possible needs to be done to ensure the company can survive the current downturn using its existing cash resources,” the miner said.

The news came on the same day Firestone reported diamond recoveries of 138,000 carats in its financial second quarter ended December, down 31% from the first quarter.

Firestone said the slump was the consequence of power disruptions at its only operating mine, Liqhobong. That led to shutting down the processing plant for most of October. The mine then ran on generator power until the start of December, at a marginally lower capacity.

Owing to the costs associated with renting and operating the generators, the company’s operating costs for the quarter under review were $1.1-million higher year-on-year.

Firestone estimated the total impact of the power disruption on the business was $4.6 million.

As a result of lower second-quarter output, the miner cut guidance for its 2020 year, ending June, to between 720,000 and 750,000 carats. It had previously estimated it would produce between 820,000 to 870,000 carats.

Global crisis

The company is just one of the many diamond miners and traders affected by ongoing weak market conditions. Producers of small stones have been hit the hardest, due to an oversupply in that segment that has dragged prices down.

Increasing demand for synthetic diamonds has also weighed on prices. Man-made stones require less investment than mined ones and can offer more attractive margins.

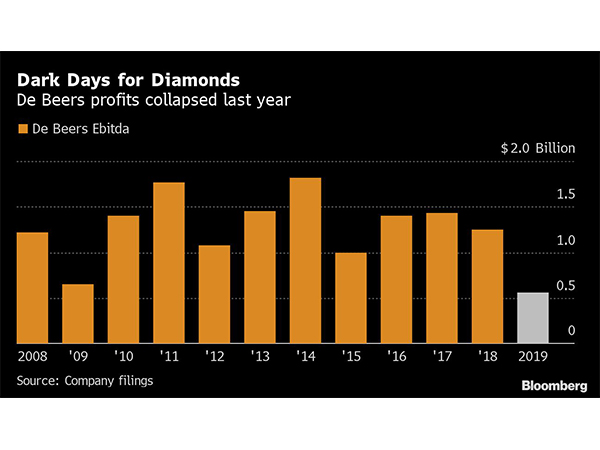

Big companies have not been immune to the downward trend. De Beers, the world’s No. 1 diamond miner, reported last week its worst set of earnings since Anglo American (LON:AAL) acquired it in 2012.

The company said demand for rough diamonds from polishers and cutters was weak last year due to the impact of US-China trade tension and the closure of US retail outlets. Many companies in the so-called midstream are struggling to obtain financing, it said.

Industry consultant Bain & Co. believes that while the glut that’s depressing the diamond market will probably be cleared early this year, it will take at least another 12 months for the market to fully recover.

“The industry’s first and strongest opportunity to rebalance and regain growth will be 2021,” said Bain in a report released in December, adding that supply could fall 8% that year.