Researchers from the University of British Columbia published the first scientific study of cobalt-blue spinel in Canada, a mineral that produces fine gemstones that range from red and pink to violet and blue. Philippe Belley, a recent PhD graduate of the department of earth, ocean and atmospheric sciences, and UBC mineralogist Lee Groat traveled to Baffin Island in the Canadian territory of Nunavut to investigate the origin of spinel’s blue variety, highly prized for its intense natural colour, high transparency and limited supply. They found that Baffin Island

Canada-listed Fura Gems Inc. (TSX-V: FUR), a new gemstone mining and marketing company headed by former COO of Gemfields (LON:GEM) Dev Shetty, has scored big as it’s added an iconic emerald mine in Colombia to its portfolio. The Coscuez mine, located in the mountainous department of Boyacá — one of the world’s best sources of emeralds —, was one of Gemfields’ flagship mines. But the company, the world’s biggest coloured gems producer, walked away from both the operation and Colombia in May this year, as it decided to focus just on its

Since their discovery in early 2009, the ruby deposits near Montepuez in Mozambique have produced an impressive number of exceptional-quality stones, including iconic gems such as the Rhino Ruby (22.04 cts), the Scarlet Drop (15.95 cts) and the Eyes of the Dragon (a pair of rubies pair weighing 11.23 cts and 10.70 cts), all of which were analysed by the Swiss Gemmological Institute SSEF. But from the very beginning, there has been evidence in the market of lower-quality rubies from Mozambique that have been heated with or without a flux (borax), resulting in healed

Sebastiao Pedro struck it lucky in 2014 when, as a 21-year-old small-scale miner, he found a large red ruby in northern Mozambique. He sold it to a buyer from Vietnam for $43,000, returned to his family 900 miles away and built a house with the proceeds. Then the money ran out. This year he went back to Montepuez, home to the world’s biggest known ruby deposit, hoping to find another small fortune. He was disappointed. A crackdown by the authorities has seen thousands of local diggers and traders arrested. Hundreds of others from as far away as Thailand

Canada’s Lucara Diamond (TSX:LUC) doesn’t seem deterred by weak conditions affecting the market as it plans to boost sales returns by targeting higher grade areas of its Karowe mine in Botswana. Delivering production guidance for 2020, the Vancouver-based miner says it expects to recover between 370,000 and 410,000 carats at Karowe next year and estimates an annual revenue of between $180 and $210 million. Lucara forecasts the income will come from selling “special” diamonds — 10.8 carats and larger, excluding truly unique finds such as the 1,109-carat Le

State-owned Zimbabwe Consolidated Diamond Co. plans gem auctions outside the country, including in Asian cities, to widen marketing options amid a market glut that’s steadily made polished stones cheaper. The company must explore and penetrate the international market to boost sales volumes and plans 11 international tenders in 2020, according to acting Chief Executive Officer Rob de Pretto. “All those big companies like De Beers and Alrosa are also doing it, so we must also be there with them,” De Pretto said in an emailed response to questions. “Harare is

They say it’s darkest before the dawn. Let’s hope that holds true for the diamond sector. We try to strike a hopeful note here at Diamonds in Canada about an industry that’s become such an inspiring and Canadian story about perseverance, determination, and the ability to adapt and change. But conditions have become very difficult of late. As Paul Zimnisky points out, we are currently in the third crisis the industry has seen in 15 years. Recent figures from diamond powerhouse De Beers are illustrative. In the first half of 2019, De Beers’

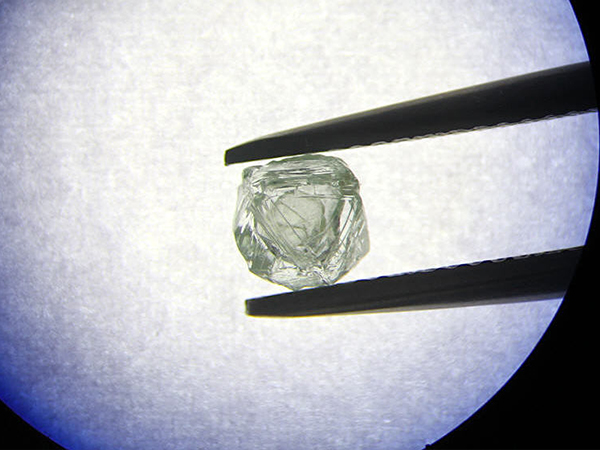

A one-of-a-kind diamond hosting another diamond inside, discovered by the world’s top producer by output, Alrosa (MCX:ALRS), at its Yyruba division in October, will remain in the company’s collection of rare finds. The selection of unique diamonds, Alrosa said on Thursday, already includes skull-shaped and football-like rough diamonds that were mined in recent years. The latest addition resembles a traditional Matryoshka, or nesting doll, with one diamond freely moving around inside another. Inclusions and flaws in diamonds are common and most have some kind o

Rio Tinto (ASX, LON: RIO) announced that its 2019 Argyle Pink Diamonds Tender collection of 64 rare pink and red diamonds saw double-digit growth in the number of bids, with successful bidders hailing from nine countries. The rocks were mined from the company’s Argyle mine in Western Australia and the collection is the 35th Tender since the operation became commercially active in 1983. “Whilst bids and total values remain confidential, Lot 1, Argyle Enigma, the most valuable diamond in the collection, was won by Australian based Argyle Pink Diamonds partner B

The crisis afflicting the diamond industry won’t end anytime soon, according to Liberum Capital Markets. There has been little good news this year. An oversupply of rough diamonds, a surfeit of polished stone stocks and falling prices have piled pressure on both the companies that dig them up and the lesser known businesses that cut, polish and trade them. “The diamond market has had a torrid year,” Ben Davis, an analyst at Liberum, said in a report on Monday. “While there is some optimism emerging from expected mine supply cuts and an end to the destoc