Africa-focused Firestone Diamonds (LON:FDI) has decided to leave the London Stock Exchange and reduce the size of its board in an attempt to reduce costs and ride out a lingering weakness in the global diamond market. Shares in the company, currently traded on the AIM exchange — the LME’s submarket for juniors — have collapsed in recent years. From 56.8p a piece in October 2016, the stock has fallen to just 0.30p as of Tuesday at 12:15 pm local time, leaving it with a market cap of £2.7 million ($4.7 million). Firestone’s investors are expecte

The 172.6-carat D-colour, Type IIa diamond discovered at Lucapa Diamond’s Lulo mine in 2016. Image courtesy of Lucapa Diamond Company. Lucapa Diamond (ASX:LOM) and its partners Endiama and Rosas & Petalas reported on Wednesday positive results from the search for the hard-rock kimberlite source of the alluvial diamonds at the Lulo diamond field in Angola. According to the company, the first stream bulk samples excavated from the Canguige tributary had resulted in the recovery of 45 diamonds weighing 30.3 ct. “We are excited about the diamond recoveries from the

Artisanal mining accounts for only 20% of global diamond production, but carries a tainted reputation that’s damaged consumer confidence for almost 20 years. (Miners in Kono District, Sierra Leone, panning for diamonds. Courtesy of USAID Guinea via Wikimedia Commons.) Russia, this year’s chair country of the Kimberley Process, a certification scheme established to prevent the trade of conflict diamonds, has vowed to work on lifting all remaining sanctions to exports of precious stones from Central African Republic (CAR). The country partially resumed diamond shi

Angola’s new diamond trading policy generated an average annual growth of gross revenue of about 8.5% in the past two years. According to a media statement issued by Sodiam – the National Diamond Trading Company of Angola-, while in the 2016-2017 period gross revenue grew by 2.3%, in 2017-2018 it grew 10.8%, totalling $1.22 billion, and in 2018-2019 it grew by 6.2%, totalling $1.29 billion. The positive results follow a 2018 decree that eliminated the figure of ‘preferred customer’ and implemented new ways of selling diamonds. Before, preferenti

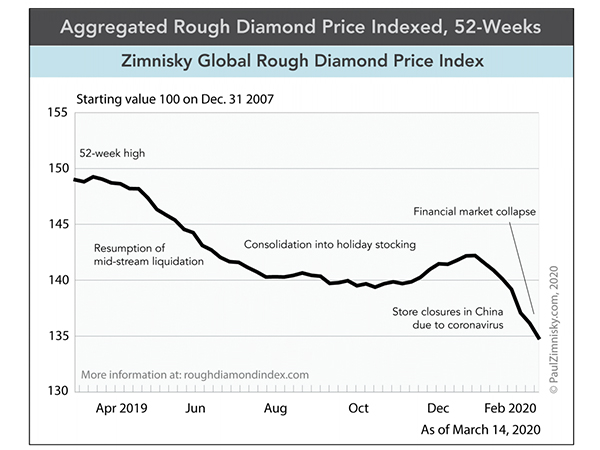

A sparsely populated shopping mall in New Jersey, second week of Marc. In mid-January the diamond industry was first directly impacted by the coronavirus labeled COVID-19 when quarantine measures were taken in China to control the viral outbreak including the temporary closure of shopping centers. An estimated 75% of jewelry stores in Mainland China, and the surrounding regions encompassing Greater China, were shut for an estimated 40-50 days through the first week of March. In addition, the measures taken in China halted diamond trade and other industry-related B2B (bu

De Beers sells its gems through 10 sales each year in Botswana’s capital, Gaborone, and the buyers — known as sightholders — generally have to accept the price and the quantities offered. (Image courtesy of De Beers) De Beers, already grappling with a prolonged industry crisis exacerbated by the coronavirus outbreak, now has another headache to contend with: how to conduct diamond sales when key customers are blocked from traveling? Botswana, where De Beers conducts its 10 sales each year, on Monday announced a travel ban on 18 high-risk countries as part o

Russian diamond miner Alrosa will relax payment terms for long-term customers in its March trade session starting this week, it said on Thursday, as diamond sales fall due to the uncertainty caused by the coronavirus outbreak. Sales by state-controlled Alrosa, the world’s largest producer of rough diamonds in carat terms, fell in February as the risks related to the spread of the virus hit demand for gemstones. “Obviously, amid such market uncertainty, it would not be right to keep our customers tied to their original contracts,” Evgeny Agureev, Alrosa deputy

(Image courtesy of De Beers Group) Just when the diamond market was beginning to show signs of recovery, De Beers, the world’s largest producer by value, revealed that the outbreak of the Covid-19 coronavirus had affected its sale of roughs in February, which dropped by 36% from January. The company sold $355 million of rough diamonds in the second cycle of the year compared with $551 million for the first cycle of the year, as it deferred allocations due to the virus impact on Chinese focused customers. The figure was 28% lower than sales in the same peri

London-listed Gem Diamonds says following pressure on prices for larger high-quality diamonds last year, signs of improvement have been noted since December. Diamond prices for smaller commercial-type diamonds also remained under pressure for most of last year, with polished inventory levels remaining high for the company, but Gem on Thursday noted that the prices of these goods had also improved in January and February. The company on Thursday published a trading update for the fourth quarter of 2019, in which the Letšeng mine, in Lesotho, delivered solid operati

London-listed Petra Diamonds has cut its cash flow targets amid a weak diamond market, owing to the coronavirus outbreak, which started to affect Chinese citizens late last year and has since spread to 24 countries. Reporting on its results for the six months ended December 31, Petra on Monday said its Project 2022 – which involves optimisations and expansion initiatives at all its mines – remained on track to deliver significant cash flow generation, reaching an annualised rate of between $50-million and $80-million. However, the company warned that the op