They say it’s darkest before the dawn. Let’s hope that holds true for the diamond sector. We try to strike a hopeful note here at Diamonds in Canada about an industry that’s become such an inspiring and Canadian story about perseverance, determination, and the ability to adapt and change. But conditions have become very difficult of late. As Paul Zimnisky points out, we are currently in the third crisis the industry has seen in 15 years. Recent figures from diamond powerhouse De Beers are illustrative. In the first half of 2019, De Beers’

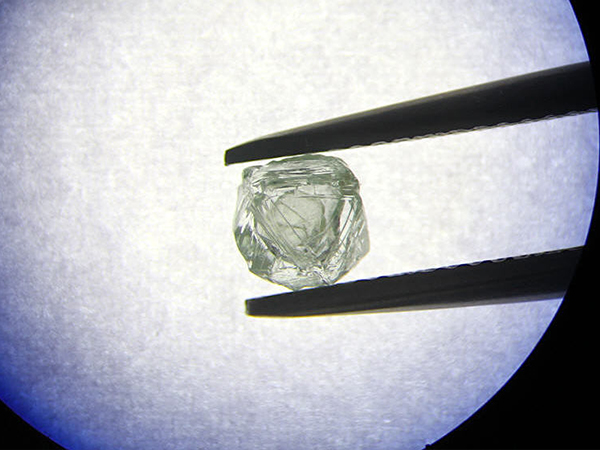

A one-of-a-kind diamond hosting another diamond inside, discovered by the world’s top producer by output, Alrosa (MCX:ALRS), at its Yyruba division in October, will remain in the company’s collection of rare finds. The selection of unique diamonds, Alrosa said on Thursday, already includes skull-shaped and football-like rough diamonds that were mined in recent years. The latest addition resembles a traditional Matryoshka, or nesting doll, with one diamond freely moving around inside another. Inclusions and flaws in diamonds are common and most have some kind o

Rio Tinto (ASX, LON: RIO) announced that its 2019 Argyle Pink Diamonds Tender collection of 64 rare pink and red diamonds saw double-digit growth in the number of bids, with successful bidders hailing from nine countries. The rocks were mined from the company’s Argyle mine in Western Australia and the collection is the 35th Tender since the operation became commercially active in 1983. “Whilst bids and total values remain confidential, Lot 1, Argyle Enigma, the most valuable diamond in the collection, was won by Australian based Argyle Pink Diamonds partner B

The crisis afflicting the diamond industry won’t end anytime soon, according to Liberum Capital Markets. There has been little good news this year. An oversupply of rough diamonds, a surfeit of polished stone stocks and falling prices have piled pressure on both the companies that dig them up and the lesser known businesses that cut, polish and trade them. “The diamond market has had a torrid year,” Ben Davis, an analyst at Liberum, said in a report on Monday. “While there is some optimism emerging from expected mine supply cuts and an end to the destoc

Shares in Africa-focused Firestone Diamonds (LON:FDI) went ballistic on Wednesday after it announced that stable power had returned to its Liqhobong mine in Lesotho, with the plant processing at full capacity. Firestone had warned in October that the mine was struggling due to insufficient power supply due to a two-month maintenance shutdown at its only power supplier — Lesotho Highlands Water Project (LHWP). As a result, processing operations were halted from the beginning of the month to Oct. 26, when diesel generators were commissioned. The plant then operated at

Anglo American’s De Beers, the world’s No.1 diamond miner by value, said on Wednesday that its last roughs sale of the year fetched $425 million, a slight improvement from the $400 million it obtained in the previous tender, but still over the year a whopping $1.4 billion less than in 2018. The figure is also 20% lower than the $544 million worth of diamonds the miner sold in December last year, and it has brought the company’s total sales for 2019 to only $4 billion. The diamond giant sells its stones ten times a year in Botswana’s cap

South Africa’s Petra Diamonds (LON:PDL) said Tuesday it had appointed mining engineer Peter Hill as nonexecutive director and chairperson to succeed founder and chairman, Adonis Pouroulis, at the end of March 2020. The company, which dropped the role of chief operating officer last month because of a management restructuring, said Hill will join on Jan. 1 as chairperson designate. Pouroulis, who founded Petra in 1997 and has been its chairman ever since, will in turn step down on March 31. The upcoming executive began his career in the gold division of Anglo

Alrosa and independent technology company Everledger are launching a new e-commerce solution on WeChat — one of the world’s largest social platforms — to help Chinese retailers track the origin of diamonds using blockchain technology. WeChat is created and operated by Chinese tech giant Tencent, which recently became an investor of Everledger. The new software will showcase diamonds from Alrosa, enabling full traceability from mine to consumer. It will also be offered as a white label API for jewelry manufacturers and retailers in China who wish to provide consu

Russia is proposing to move toward ending the ban on selling so-called blood diamonds from the Central African Republic, a former French colony that’s struck recent military and commercial ties with Moscow, amid resistance from the U.S. and Europe. The CAR, which is mired in civil conflict, should be granted a “road map” outlining the steps it needs to take to get the suspension of diamond sales lifted, Russian Deputy Finance Minister Alexei Moiseev said in an interview in Moscow. “We need to ensure that illicitly traded diamonds move to the legal marketpl

The glut that’s depressing the diamond market will last another year, according to industry consultant Bain & Co. The inventory backlog will probably be cleared in the beginning of 2020, but it will take some time for the market to fully recover, Bain said in a report released on Wednesday. Bank financing to the industry’s midstream — the traders that buy rough gems for cutting and polishing — will continue to drop next year, the consultant said. “The industry’s first and strongest opportunity to rebalance and regain growth will be 2021,” said