Russian diamond miner Alrosa will relax payment terms for long-term customers in its March trade session starting this week, it said on Thursday, as diamond sales fall due to the uncertainty caused by the coronavirus outbreak. Sales by state-controlled Alrosa, the world’s largest producer of rough diamonds in carat terms, fell in February as the risks related to the spread of the virus hit demand for gemstones. “Obviously, amid such market uncertainty, it would not be right to keep our customers tied to their original contracts,” Evgeny Agureev, Alrosa deputy

(Image courtesy of De Beers Group) Just when the diamond market was beginning to show signs of recovery, De Beers, the world’s largest producer by value, revealed that the outbreak of the Covid-19 coronavirus had affected its sale of roughs in February, which dropped by 36% from January. The company sold $355 million of rough diamonds in the second cycle of the year compared with $551 million for the first cycle of the year, as it deferred allocations due to the virus impact on Chinese focused customers. The figure was 28% lower than sales in the same peri

London-listed Gem Diamonds says following pressure on prices for larger high-quality diamonds last year, signs of improvement have been noted since December. Diamond prices for smaller commercial-type diamonds also remained under pressure for most of last year, with polished inventory levels remaining high for the company, but Gem on Thursday noted that the prices of these goods had also improved in January and February. The company on Thursday published a trading update for the fourth quarter of 2019, in which the Letšeng mine, in Lesotho, delivered solid operati

London-listed Petra Diamonds has cut its cash flow targets amid a weak diamond market, owing to the coronavirus outbreak, which started to affect Chinese citizens late last year and has since spread to 24 countries. Reporting on its results for the six months ended December 31, Petra on Monday said its Project 2022 – which involves optimisations and expansion initiatives at all its mines – remained on track to deliver significant cash flow generation, reaching an annualised rate of between $50-million and $80-million. However, the company warned that the op

Diamond miners Gem Diamonds delivered solid operational results for the year ended December 31, which, together with the targeted gains of a business transformation programme and continued emphasis on cost controls, affirmed it as one of the lowest-cost producers in the industry, CEO Clifford Elphick said on Wednesday.The operational results were characterised by the achievement of all guided operational metrics and the recovery of 11 diamonds greater than 100 ct each, which also brought the total number of diamonds of greater than 100 ct recovered at the Letšeng

TSX-V-listed junior diamond miner Diamcor Mining has started using a new, larger fleet of Caterpillar heavy mining equipment at its Krone-Endora at Venetia project, based next to diamond miner De Beers’ Venetia mine, in Limpopo. Diamcor started off by processing tailings material at Krone-Endora. The new equipment will provide it with improved reliability, lower operating costs and support its planned increases in processing volumes going forward. The equipment is comprised of a full complement of large excavator models, articulated dump trucks, front-end loaders, bull

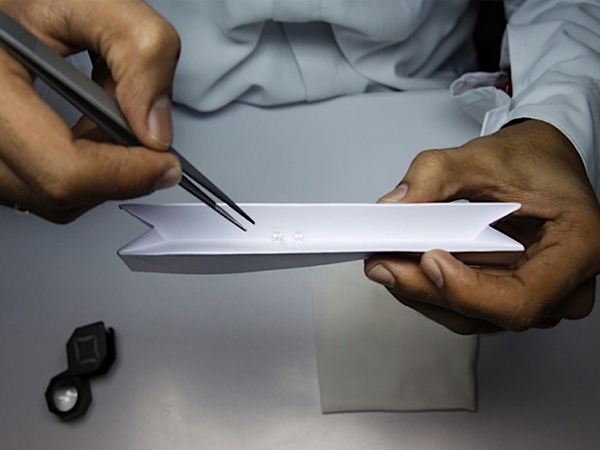

LSE-listed Gem Diamonds has highlighted the recovery of a number of top-quality white, as well as one pink, diamond from its Letšeng mine, in Lesotho, between February 28 and March 3. Five white gem diamonds, weighing between 33 ct and 114 ct, were recovered, along with a 13 ct pink gem diamond. Earlier in February, Gem had recovered an exceptional 183 ct white Type IIa diamond from the Letšeng mine, the highest dollar per carat kimberlite diamond mine in the world. It has also recovered two other significant high-quality diamonds, weighing 89 ct and